CB Insights recently published its State of Venture 2022 Report - CB Insights Research. As detailed below, several interesting insights show the impact that rising interest rates, declining public equities, and increased global political uncertainty are having on the venture capital market.

First and most significantly, we have now started to see the 2021 VC bubble consistently deflate across each quarter of 2022. Specifically, global VC funding for 2022 totalled USD 415B, down 35% year-on-year (YoY); however, total deal volume declined by 4%, as shown in Figure 1 below.

This is because late-stage deals, which are larger investment sizes at higher valuations and, hence, contribute to a larger proportion of global VC funding, have been impacted to a greater extent than other stages, which has had a relatively larger impact on total deal funding. We can see the impact of this with late-stage deals contributing to a relatively smaller percentage of total VC deals, and early-stage deals have climbed to a record high of 66% of all VC deals, as shown in Figure 2 below.

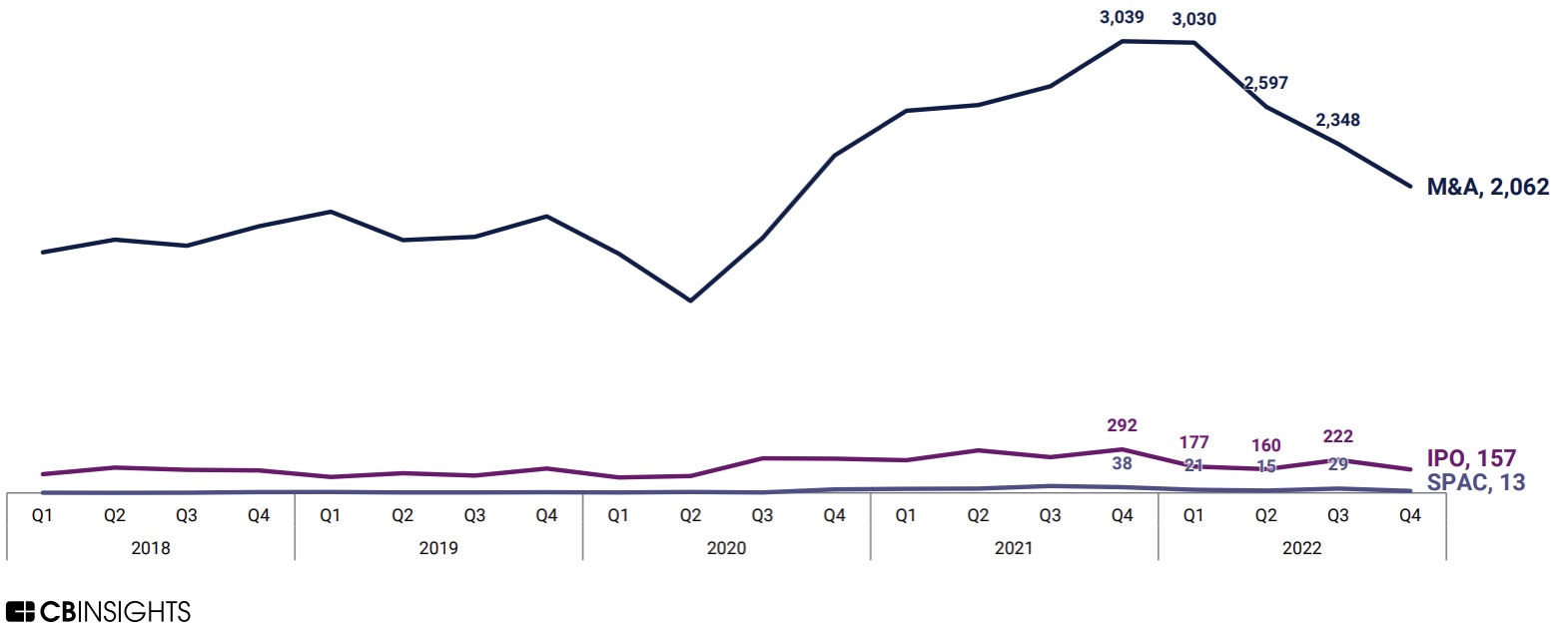

The fall in venture capital funding and late-stage deals is because the VC exit market has been impacted by declining public equities, particularly technology stocks. For example, the NASDAQ Composite has fallen from a record high of 16,057 on 19 November 2021 to under 11,000 as of 20 January 2023. Accordingly, public listings of VC-backed companies have not been immune to the market slowdown, with the number of initial public offerings (IPOs) and M&A activity decreasing YoY, as shown Figure 3 below. This is arguably because companies that previously raised at record-high valuations look to stay private longer by raising additional capital or exiting via acquisition to avoid the less appealing public market valuations.

This has particularly impacted so-called “mega-rounds” (VC rounds with USD 100M+ investment sizes) as the value of companies closest to exit markets are to be first impacted by any declines in public equities. Specifically, funding for USD 100M+ mega-rounds has fallen to USD 190.1B – a 49% decrease from 2021 – and the number of mega-round deals fell by 42% to 923 in 2022, as shown in Figure 4 below.

This has resulted in a sharp decline in the number of new unicorns (VC-backed companies with a valuation of USD 1B+) being created to only 19 in 2022. However, the total number of unicorns has barely increased from 1,199 to 1,205 as there have potentially been some down rounds and unicorns being acquired and listing on stock exchanges. It will be interesting to see whether the total number of unicorns begins to decline throughout 2023 as the number of new unicorns created continues to decline and the number of unicorns having down rounds continues to increase.

Overall, it appears the period of low interest rates and cheap money since the 2007-08 Financial Crisis has come to an end. In combination with increasing global economic and political uncertainty, this has resulted in declining public equities, which has started to impact late-stage VC and feed into early-stage VC in the US. Whether this materialises into more severe declines in valuations in the US and Europe, potentially impacting Seed and Angel rounds, will depend on the global economy, interest rates, and public equities throughout 2023 and 2024. The global economic outlook is looking increasingly bleak, with the World Bank recently revising its 2023 global economic growth forecast down to 1.7% in Jan-23 from its forecast of 3.0% in Jun-22 (Global Economic Prospects -- January 2023 (worldbank.org)).

Regardless, we would expect to see early-stage venture deals maintain the recent level of activity as investors look for long-term synergies and returns. At Btomorrow Ventures, for instance, we are more interested in the long-term strategic alignment with BAT and are less focused on short-term fluctuations; thus, we remain committed to supporting our portfolio companies and new investments that are aligned with our investment strategy.